what is tax planning explain its characteristics and importance

Read through the article to learn more about the meaning of tax planning the importance of tax planning and its benefits. Planning Contributes to the Objective-Planning helps in achieving the objective.

How To Answer The 7 Most Important Job Interview Questions

There are three key characteristics of tax planning.

/062602_final-d846dd6f8f774903b72cb53f0c042116.png)

. When you or your accountant prepare your income taxes you are looking backwards. Tax planning enables corporates to contribute towards the economic growth of our country. Tax planning allows all elements of the financial plan to function in sync to deliver maximum tax efficiency.

One thing we also know is that tax planning is VITAL to creating a flow of income in retirement that is FREE from or at least minimizes your tax liabilities when living on a retirement income. The use of tax payers is to guarantee tax effective. That is where the importance of these lies reducing tax levels allowing greater control thereof reducing potential penalties and maximizing tax relief andor tax credits.

Tax planning refers to the process of minimising tax liabilities. It also conforms to the provisions under taxation laws thereby minimizing any litigation. One other reason why you need to file taxes is to contribute to a nations development.

I Reduction of tax liability. Tax planning helps you save money. Tax Planning - Importance and Benefits of Tax Planning.

Tax planning refers to financial planning for tax efficiency. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and benefits to minimize his tax liability each financial year. Tax planning enables you to create an updated record of your finances something that most people either dont bother with or leave it for someone else to do it.

Understand the objectives of tax planning in India and its various types along with their benefits and importance. Tax planning is the logical analysis of a financial position from a tax perspective. Planning your finances in such a way that you attract the least amount of tax and the process of tax filing.

As a result tax planning affects all aspects of your money matters. Tax Planning follows an honest approach to achieve maximum benefits of tax laws by applying the script and moral of law. This helps you legitimately avail the maximum benefit by.

Tax planning helps channelize taxable income to various investment plans. The term tax planning refers to the technique used for analyzing the financial situation of an individual to design investment and exemption strategy with the objective of ensuring optimum tax efficiency. It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as possible.

Basic Characteristics of a Tax. It facilitates the coordination of. Know more by clicking here.

Investors analyses and invest in those that provide a better rate of return at lower risk. Planning for tax is not just. There are three key characteristics of tax planninginvesting to reduce taxes.

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. For business owners this means looking both at company taxes as well as personal taxation. Tax planning includes making financial and business decisions to minimise the incidence of tax.

It would be in the interest of assessee to _plan the tax affairs properly and avail the deductions exemptions and rebate admissible under the Act. As a result tax planning affects all factors of your money matters. Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc.

Use of tax relief legislation. The company will achieve a higher cash flow allowing. Tax planning strategies are often used to help companies achieve their financial and business targets.

What is Tax Planning. Why is business tax planning important. Discuss the objectives importance and types of tax planning.

Tax planning is essential as. This can be done by making use of deductions available in the country. In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances exclusions exemptions and deductions.

Planning your finances in such a way that you attract the least amount of tax The process of tax filing. Tax planning is critical for budgetary efficiency. Every taxpayer wishes to retain a maximum part of the earnings rather than parting with it and facing the resource crunch.

What does tax planning mean. What is Tax Planning. Planning is nothing but thinking before the action takes placeIt helps us to take a peep into the future and decide in advance the way to deal with the situations which we are going to encounter in future.

This is why you require tax planning. Tax planning a taxpayer reduces his liability towards paying takes. Planning is a first and foremost managerial function provides.

Importance of Planning. The objective behind tax planning is insurance of tax efficiency. In other words it is the analysis of a financial situation from the taxation point of view.

A sound tax plan requires all the elements of a financial plan to work in unison in the most tax-efficient way. This kind of planning is different than preparing your income tax returns. Tax planning reduces tax liabilities by saving the maximum amount of tax by arranging and guiding the financial operations according to tax savings.

It involves logical thinking and rational decision making. Tax planning facilitates the smooth functioning of the financial planning process. It enables you to stay up to date with market trends government policies.

Investing to reduce taxes. Proper tax planning brings economic stability by various techniques such as mobilizing resources for national projects or availing ways for investments which are productive in nature. The primary concept of tax planning is to save money and mitigate ones tax burden.

Compliance regarding tax payment reduces legal hassles. The prime objectives of tax planning are. Why is tax planning important.

What S The Difference Between Transactional Vs Transformational Leadership Leadership Leadership Words Leadership Advice

Capital Gains Accounting And Finance Capital Gain Bookkeeping And Accounting

Most Important Job Functions In 2022 For A Procurement Department

The Importance Of Consolidated Financial Statements Cfms Financial Planning And Reporting

Is Apple Going To Follow In The Footsteps Of Amazon Cloud Based Services Cloud Infrastructure Cloud Services

Income Stock Meaning Characteristics Advantages Criticisms And More Accounting Education Finance Infographic Financial Management

11 Elements Insurance Proposal Forms Proposal Form Example Form

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Stepbystep Finance Budget Money Free Freedom Tips Tiptuesday Amazing Read Ideas Learn Basic Investing Infographic Investing Finance Investing

The Importance Of Accounting To A Restaurant

Income Tax Multiple Choice Questions Mcq With Answers Updated Income Tax Income Tax Day

Advantages And Disadvantages Of Joint Stock Company Joint Stock Company Stock Companies Company

The Management Of Tax Risks In Mergers And Acquisitions The Importance Of Tax Due Diligence Intechopen

/062602_final-d846dd6f8f774903b72cb53f0c042116.png)

Factors To Consider When Evaluating Company Management

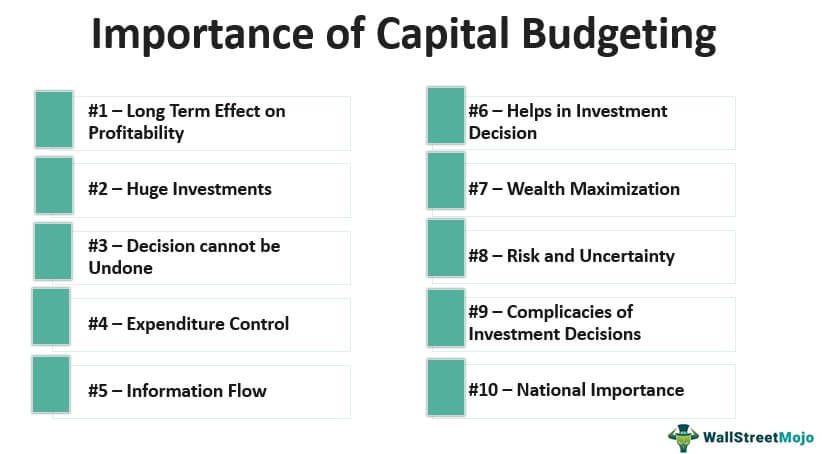

Capital Budgeting Importance List Of Top 10 Reasons With Explanation

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

What Is The Importance Of Cost Estimation

Staffing Definition Nature Importance Mymcqhub Training And Development Business Management Staffing